2.7. Bank reconciliation¶

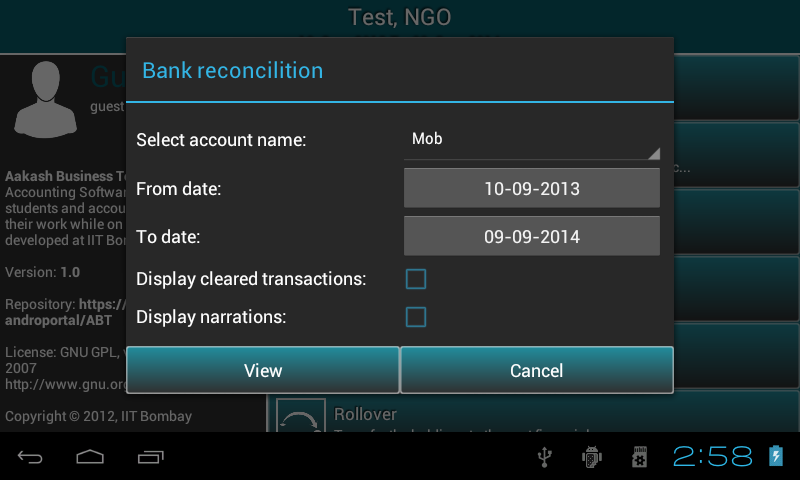

- When the user clicks on the Bank Reconciliation Statement under Masters menu, it pops up a dialog box.

- A list of bank account names will be populated. The user selects one of the account names displayed and gives the from date and to date i.e the time period. By default it is organisation’s financial from date and to date. Change date as per the requirement.

- Check the first check box to view cleared+uncleared transactions and second one to view transactions with narrations.

- Press View.

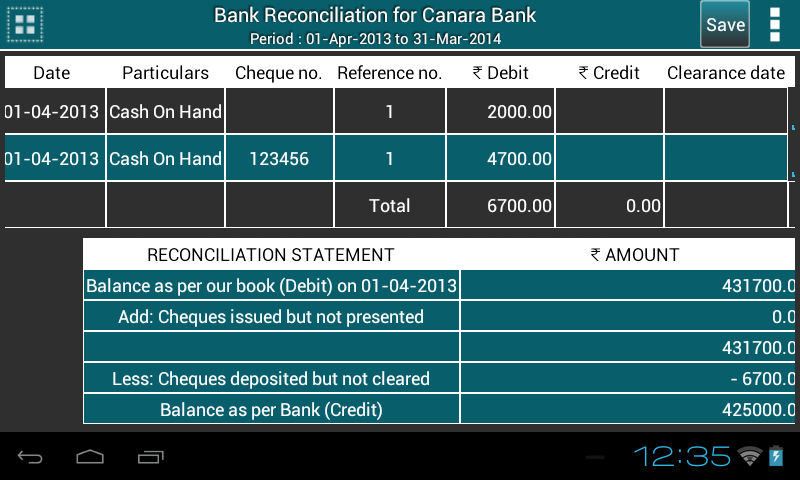

- A Ledger for that period for the selected account will be displayed to the user with the fields: Date, Particulars, Cheque number, Reference Number, Debit Amount, Credit Amount, Clearance date & Memo. This shall consist all the reconciled transactions with the clearance date and not-reconciled transactions along with all not-reconciled transactions from the start of the organisation (i.e start date of the company) to the entered to date.

Total Debit & Total Credit are displayed in the last row of the table.

Bank Reconciliation Statement is located at the bottom of the table.

If the user wishes to reconcile now, he clicks the Clearance date column. The clearance date field and memo are the Text input areas for the user to enter valid data.

The user enters the date and some text in the memo (if he wishes to) and clicks on Save button(located at the title bar).

There are 3 conditions to decide if the transaction has to be reconciled or not.

Condition 1: If clearance date has been entered and memo field is empty, the transaction is cleared i.e reconciled. Condition 2: If clearance date has NOT been entered by the user, then, this transaction will be reconciled in the future.

On clicking Save, the transactions which fall into Condition 1 will be the only ones which will be reconciled.

So the Bank Reconciliation Statement will get updated automatically.

Click on the table row to see the details of the transaction. In accounting terms this fuctionality is called Drilldown.

In options menu two features are provided: export report in PDF or CSV format.

To change the input informations, user can click on button present in top-left corner of the screen.